Department of Agriculture, Fisheries and Forestry – Agri-Business Expansion Initiative

The Australian Government is investing $72.7 million to help Australian agribusinesses expand their export markets in 2021 as part of the Agri-Business Expansion Initiative.

Key elements of the initiative include new one-on-one exporter support services, greater access to market intelligence, and matched grants for government and industry associations to work together on market expansion. The Agricultural Trade and Market Access Cooperation (ATMAC) Program is open for applications that "help Australia's agricultural sector to open, improve and maintain access to overseas markets by building stronger, mutually beneficial relationships with trading partners, neighbouring countries and international organisations".

For more information on the Agri-business Expansion Initiative, visit www.agriculture.gov.au/market-access-trade/agri-business-expansion.

For more information on Australian Seafood Exporting, visit https://www.exportingseafood.com.au/.

International trade is a key component of the Australian seafood industry

Australia exports about half of its annual fisheries and aquaculture production by value, specialising in high unit value products for the growing Asian market. As a trade-exposed industry, the seafood sector is subject to trends in world markets, global market disturbances (such as COVID-19), key trading partners and the effect of Australia's exchange rate on the price received for exports and for competing imports.

One of the most significant threats to Australian seafood exporters is the current lack of market diversification.

Dependence on limited Asian export markets carries significant commercial risk as was evident during the Severe Acute Respiratory Syndrome (SARS) outbreak in 2003 and more recently the COVID-19 outbreak. The Australian seafood sector is increasingly looking to further develop alternative global export markets such as the United Kingdom, the European Union, the United States and India in order to minimise risk exposure.

Australian seafood exports

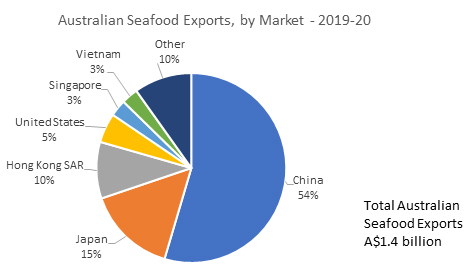

In 2019-20, seafood exports totalled $1.4 billion or about half of the total value of production. Seafood exports were down eight per cent on the previous year largely as a result of the effect of COVID-19 on global trade in the second half of the reporting period and ongoing trade tensions with China.

Four key export markets accounted for 84 per cent of total Australian edible and non-edible seafood exports in 2019-20. (See figure 1.) They included:

- China $770 million (54 per cent)

- Japan $215 million (15 per cent)

- Hong Kong SAR $136 million (10 per cent)

- United States $71 million (five per cent).

Figure 1.

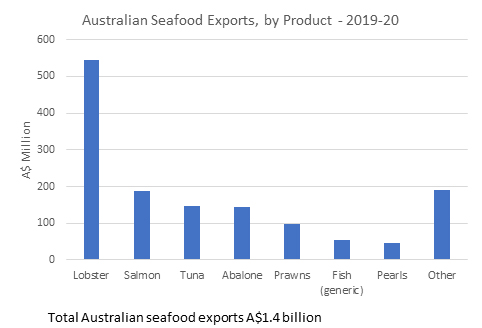

Five seafood products accounted for 79 per cent of total Australian edible and non-edible seafood exports in 2019-20. (See figure 2.) They included:

- Rock lobster $544 million (39 per cent)

- Salmon $189 million (13 per cent)

- Tuna $146 million (10 per cent)

- Abalone $144 million (10 per cent)

- Prawns $98 million (seven per cent).

Figure 2.

Australian seafood imports

Australia's level and composition of seafood production means imports are required to fill the gap between Australia's seafood consumption and local seafood supply. Whereas Australian fishery and aquaculture exports are dominated by high unit value products such as Rock Lobster, Atlantic Salmon, Southern Bluefin Tuna and Abalone. Imports of fishery and aquaculture products largely consist of lower unit value products such as canned or frozen finfish but also include higher unit value products such as prawns and salmonids.

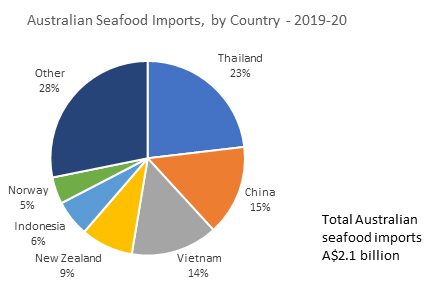

Despite the importance of Australian seafood exports to the profitability of the industry, Australia is a net importer of seafood. In 2019-20 Australia imported seafood valued at $2.1 billion from 97 countries. Six key countries accounted for 72 per cent of total Australian seafood imports. (See figure 3.) They included:

- Thailand $482 million (23 per cent)

- China $341 million (15 per cent)

- Vietnam $301 million (14 per cent)

- New Zealand $181 million (nine per cent)

- Indonesia $126 million (six per cent)

- Norway $93 million (five per cent).

Figure 3.

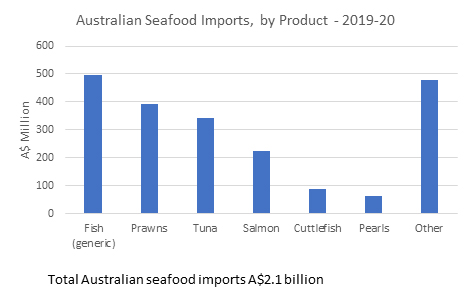

Six seafood products accounted for 77 per cent of total Australian edible and non-edible seafood imports in 2019-20. (See figure 4.) They included:

- Fish (generic) $497 million (24 per cent)

- Prawns $393 million (19 per cent)

- Tuna $341 million (16 per cent)

- Salmon $223 million (11 per cent)

- Cuttlefish $88 million (four per cent)

- Pearls (including imports) $64 million (three per cent).

Figure 4.