The increasing value of aquaculture and a larger market share for domestic seafood are highlights of the latest fisheries and aquaculture statistics

By Catherine Norwood

Aquaculture has overtaken commercial wildcatch as Australia’s leading provider of fish and seafood by value, reaching 51 per cent of gross value of production (GVP) or $1.6 billion, compared to $1.58 billion for wildcatch in 2019–20.

The volume of aquaculture production increased by 11 per cent during the year, although commercial wildcatch continued to provide the bulk of product by weight – 62 per cent compared to aquaculture’s

38 per cent, or 179,261 tonnes compared to 106,139 tonnes.

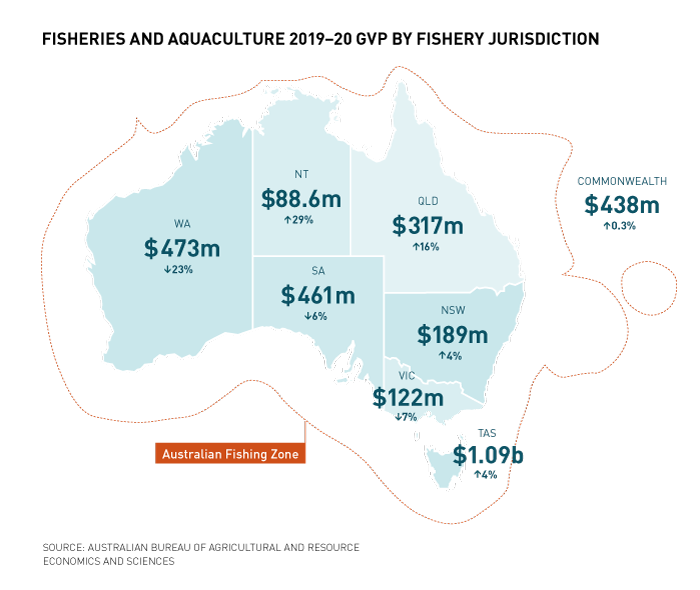

However, the total value of Australia’s production dropped two per cent to $3.11 billion in 2019–20, from $3.18 billion the year before.

In the FRDC-funded annual Australian fisheries and aquaculture statistics 2020, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) attributes the decline in total value to a combination of factors. These include reduced rock lobster exports, as a result of COVID-19 restrictions and lower export demand, and reduced catch of several other wild species.

The value of exports dropped by eight per cent (to $1.4 billion) and imports fell by four per cent (to $2.2 billion). The market share for imports also continued to decline, continuing a consistent trend since 2013–14 when it peaked at 68.9 per cent of seafood consumed in Australia. In 2019–20, the market share of imports was 61.9 per cent, a decline of one percentage point from the previous year.

Overall, seafood consumption in Australia is continuing to decline. ABARES says the total apparent seafood consumption was 12.4 kilograms per person in 2019–20, compared to a peak of 14.9 kilograms in 2012–13.

Projections

ABARES predicts the value of production will have continued to fall in 2020–21, caused largely by disruptions to domestic and international market conditions, including measures to address the spread of COVID-19.

These include demand-side disruptions to domestic and international markets and supply-side disruptions from social distancing measures across fishing and aquaculture activities, and difficulties in crewing vessels and sourcing inputs in some sectors. Industry initiatives such as moving from food service to retail sales have helped to mitigate some impacts.

However, the lower demand across much of the sector, which reduced GVP to $3.11 billion in 2019–20, is expected to continue. A further decline in GVP of six per cent in real dollars to $2.94 billion GVP is projected in 2020–21, before value begins to recover slowly.

Projections over the medium term (2021–22 to 2025–26) are highly uncertain, and the value of production is expected to remain below pre-COVID-19 levels during this period. While these are ABARES predictions, the commercial fishing and aquaculture sectors have shown remarkable resistance and capacity to grow that has confounded predictions.